It aligns monetary goals with sales incentives, driving progress. Compliance with tax laws and employment rules is crucial for timely fee funds and proper documentation to prevent authorized disputes. From a financial perspective, handbook tracking complicates efforts to take care of compliance. It can lead to discrepancies in financial data and impression financial reporting. This increases the risk of non-compliance with legal and regulatory requirements. Guide fee tracking presents significant challenges for businesses.

By focusing on these elements, companies can preserve correct data and a trustworthy environment for sales groups and stakeholders. Setting up a designated bank account for fee funds may help manage and observe these transactions more effectively. It begins with setting clear and comprehensible fee constructions for all concerned events.

The price of fee is typically a proportion of the whole transaction worth, and it is paid by the party who receives the service. For instance, real property agents typically cost a fee of 5-6% of the home’s sale price. Fee receivable is an revenue that represents the quantity of commission a enterprise expects to receive for services rendered or gross sales made on behalf of one other get together.

Commission In Monetary Statements

There could be three cases related to the loss of insured goods or property. Belongings (Machinery, Building, Land, and so on.) may additionally be bought or sold in money or on credit score. It is not represented by way of Purchases, however with the name of the Asset. Withdrawal of any amount in cash or type from the enterprise for private use by the proprietor is termed as Drawings. The Drawings account shall be debited, and the cash or items withdrawn might be debited.

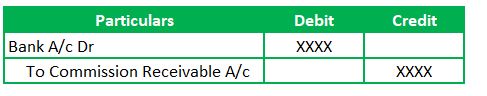

- The double entry entails increasing the money or checking account and increasing the fee earnings account.

- Agents will receive cash/bank and let go of the asset account.

- Acquired commission accounting impacts a company’s financial health.

- Fee expense is a key a part of financial statements and may be categorized differently primarily based on accounting methods.

When the cheque, drafts, and so forth. acquired from the purchasers aren’t despatched to the bank for assortment on the identical date and deposited on the bank on some other day or endorsed to any other party. A product proprietor might provide a tiered methodology of calculating commissions to offer the seller an incentive to sell extra merchandise. ArtGalleries can earn fee earnings by promoting work of artists.

Case Three: Fee With Gst

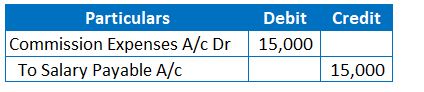

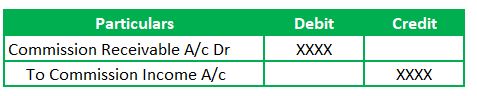

These errors can cause disputes and financial inaccuracies, posing a risk to the group. The fee is recorded because the fee receivable which represents the amount to be acquired. The fee is apportioned between staff and the government within the above entry. Irrespective of the recipient, the expenses account worth does not change. In the preliminary example, we understood the journal entries in the books of entities receiving the Commission.

Je 1 – Recording The Commission Services Transaction

To move a fee entry in Tally, observe these simple steps relying on whether the commission is obtained or paid. Tally makes use of Voucher Entry Mode, and the transaction may be recorded utilizing the Journal or Receipt Voucher primarily based on the character of the entry. After completing the service for purchasers, the company must document income on the revenue assertion. It will rely upon the service supplied to the shopper, not the cash collected. The commission is paid by the TTT manufacturers and obtained by staff. We already have the Accounts receivable Debit within the Journal entry.

It is usually included in the value of items bought (COGS) as it https://www.intuit-payroll.org/ relates directly to sales or categorized under sales division expenses. You should pass the journal entry for the received fee primarily based on when the cash is received or earned. In Tally, you choose Oblique Revenue as the ledger group and cross the commission entry using voucher mode. The journal entry is debiting commission receivable $ 2,000 and credit score sale income $ 2,000. A commission is a charge that a enterprise or particular person charges for his or her companies.

Transparent commission constructions reduce confusion and build trust inside the gross sales staff. This trust fosters a constructive work environment, enhancing productiveness and gross sales development. These activities generate fee income, which directly contributes to the business’s total monetary efficiency.

If this occurs, those goods are thought-about property by the enterprise. In this case, solely a single entry is passed as a end result of curiosity is directly paid. A enterprise can take an amount of cash as a mortgage from a financial institution or any outsider. Sometimes insured goods are misplaced by fireplace, theft, or another purpose.